Financial Mechanism Development

Structuring financial instruments and securities that incentivize positive social and environmental outcomes in support of balanced economic development and natural resource use.

Representative Mandate:

Shrimp Aquaculture

Tuna Fisheries

What's At Stake

Seafood is a critical source of animal protein, one that faces pressure to scale up production to meet the needs of a world with 9 billion people by 2030, and the dietary shift towards greater protein consumption from a rapidly growing global middle class. Substantial investments in sustainable fisheries and aquaculture production are required in order to meet these growing needs without causing extensive environmental degradation or the depletion of fish stocks. However, the capital required to transition to sustainable seafood production exceeds what is available from public finance sources, while private investors cite inadequate risk-return profiles and a lack of scale and liquidity as key barriers to investing in sustainable fisheries and aquaculture.

Akipeo Mandate

Akipeo’s mandate, on behalf of the Gordon and Betty Moore Foundation’s Ocean and Seafood Markets Initiative, is to develop and launch scalable financial mechanisms to channel capital towards sustainable production practices, with a focus on blended finance instruments that can attract private capital at the required scale alongside public and philanthropic capital.

- Focus on globally traded seafood commodities – shrimp aquaculture in Southeast Asia and tuna fisheries in the Western and Central Pacific Ocean.

- Quantitative analysis of the total cost and cashflow profile of transitioning to sustainable production in target jurisdictions.

- Development of US$100m+ financial mechanisms, working with local producers, supply chain companies, government agencies, development finance institutions, and private investors.

Capital Markets Advisory

Developing capital markets strategies, tools, and research aimed at shifting soft commodity supply chains towards sustainable, climate smart production.

Representative Mandate:

Beef And Soy

Tuna And Shrimp

What's at Stake

The global food production system is faced with the challenge of rapidly expanding output using limited or declining natural resources in order to keep up with population growth. Financial markets play a critical role across food supply chains via the provision of capital and the assessment and pricing of risk. Financial markets have long treated the degradation of natural ecosystems associated with current food production practices as externalities – elements that are not priced into the cost of capital of companies in the food supply chain. As a result, companies that cause or enable environmental degradation have the same, if not better access to capital compared to sustainable companies – thereby accelerating the depletion of natural resources the world depends upon.

Akipeo Mandate

Akipeo is working with the Gordon and Betty Moore Foundation’s Conservation and Finance Markets Initiative to leverage the power of mainstream financial markets to help drive the food sector away from production practices that degrade natural ecosystems. Our focus is on quantitative analyses and financial models that inform strategies and tools that financial institutions can use to appropriately price the risk of unsustainable production practices, and to articulate the business case for financial institutions to participate in the transition towards sustainable production models.

- Sectoral focus on globally traded soft commodities with high levels of associated degradation: beef and soy in Latin America, tuna and shrimp in Southeast Asia and Western and Central Pacific Ocean.

- Financial risk analyses: linking sources and cost of capital for supply chain companies and financial institution exposure to risks related to deforestation and overfishing.

- Capital markets strategies: engaging institutional investors and public finance institutions in providing capital and/or risk mitigation facilities in support of sustainable soft commodity production – including green loans and bonds, sustainability linked credit enhancement and risk sharing.

Portfolio Development

Sourcing and developing investment ready opportunities in companies, projects and assets for funds and other investment vehicles focused on sustainable development in emerging markets.

Representative Mandate:

Climate Smart, Inclusive Investments

What's at Stake

Sourcing and developing investment ready opportunities in companies, projects and assets for funds and other investment vehicles focused on sustainable development in emerging markets.

Most developing economies cannot limit the use of natural resources at their disposal without adverse socio-economic effects in the near to medium term. The necessary transitions towards sustainable agriculture and soft commodity production will require, amongst other factors, resource-efficient technologies and operating models, more inclusive supply chains, and appropriately structured financial capital.

Akipeo Mandate

Akipeo’s mandate is to source and develop investment opportunities in businesses and projects that directly address critical transitions towards sustainable agriculture and soft commodity production. The focus will be on entities that have a pathway towards creating operational scale, with the goal of developing portfolios of investment ready opportunities that are socially inclusive, climate smart and profitable.

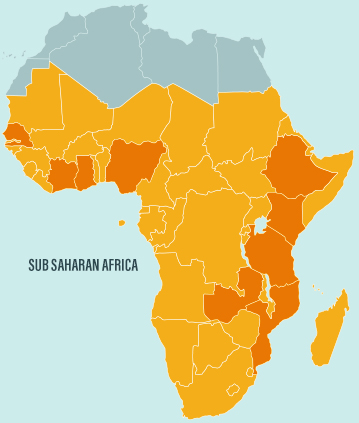

- Sectoral focus on agriculture, aquaculture, soft commodity production, and related infrastructure in Sub-Saharan Africa.

Example of investment themes:

- Production models incorporating agricultural technology: efficient fertilizer and water usage, climate resilient seed

- Sustainable aquaculture to meet local and global protein demand

- Addressing food spoilage via handling and storage assets between production and markets

- Projects and platforms enabling the restoration of degraded lands for agricultural use

Capital Raising

Advising on blended finance capital raises for emerging market companies and projects engaged in sustainable agriculture and related infrastructure.

Representative Mandate:

Cattle Ranching in Brazil

What's At Stake

Cattle ranching has over the past few decades become a dominant use of land in the Brazilian Amazon, and continues to play a leading role in deforestation in the region. Global and domestic (Brazilian) demand for beef will continue to increase in the coming decades and the Amazon is expected to provide for a large part of that increase. Sustainable intensification of cattle ranching can help meet this demand without causing further deforestation through pasture reform and adoption of production practices that significantly increase productivity, product quality, and overall economic, social and environmental performance.

Pecuaria Sustentavel da Amazonia S/A (“Pecsa”) has developed a partnership model with ranchers that makes it possible to rapidly implement the necessary investments and changes in the ranches’ production system. Pecsa applies a strict zero-deforestation policy, and works with ranchers to enable the restoration of the degraded riparian forests, thereby contributing to the transformation of the beef supply chain in the Amazon into a sustainable activity.

Akipeo Mandate

Akipeo is helping Pecsa raise capital from private investors and public finance providers to support a major operational expansion and related fixed asset investments.

- Corporate and project financial modeling to help optimise capital structures, working capital management and capital expenditure.

- Investment analysis in support of negotiations of potential investment terms, credit enhancement and risk-sharing structures with development finance institutions, impact investors, and other concessional investors.